Translate

Wednesday 25 January 2017

Swiss Space Systems - Latest Development

Interesting development in the Swiss Space Systems (S3) story.

The owner has been accused of arranging his own assault:

http://orbiterchspacenews.blogspot.co.uk/…/s3-jaussi-accuse…

As background: S3 is the company that Amin Foratti gave a Bank Loan guarantee of miilions of dollars to, when he was CFO of Traffic Monsoon. Amin has since disappeared and has various Fraud charges now being investigated against him.

Tuesday 24 January 2017

Click Intensity - The Relaunch!

This is Nick Johnson, the owner of Click Intensity.

If you've ever watched one of his videos, you'll probably feel the hairs on the back of your neck stand out. He gives a whole new meaning to the word 'sleaze'.

He has all but stopped payouts at Click Intensity, blaming Advcash for freezing funds, which has already been exposed as a lie. Advcash themselves say this isn't true.

Click Intensity is about to be 're-launched', which is ponzi speak for 'so long suckers!'

The new company, without a name, has the worlds first Digital Currency!

'CRYPTOCURRENCY BUILT ON LATEST BLOCKCHAIN TECHNOLOGY '

...or in laymans terms - SCAM

If you have funds in CI, please try for a Chargeback, don't let Nick get away with your money.

'Just finalized the landing page design and logo for upcoming launch In the next 48 hours backoffice design and technical implementation will also be done and then we will move on to data migration from CI system to new launch system !

Excited for the next phase of growth and a great 2017 !

With a trillion $$$ advertising industry market and with our strong base of 140k members , we will be world's first to launch a ethereum block chain based smart contract coin for the online advertising niche

Think about the potential

As per our research wing , we can easily take the coin to exchange at a price of about a $1 in the next 90 days alone and to upto $10 in the next 12 months

Lot of wealth about to be created

Tighten your seat belts and get ready for this million $$$ launch and billion $$ company ahead

Focus , Focus , Focus and get your teams ready !

Thanks

Nick Johnson

P.S 10 % of the profits from new launch will go in clearing old withdrawls also till the time our legal team manages to get funds back from payment processors .....

So the bigger we make the launch as one collective unit , faster will be old withdrawls also and together we as one happy family will ride the trend and stay for ever

CI for life !'

Thursday 12 January 2017

The Advert Platform/My Advertising Pays and the Payment Processors.

According to the recent court documents and video evidence from Mike himself:

Affiliates gave money to My Advertising Pays (MAP).

MAP gave money to VX GATEWAY (and moved millions out of the country).

VX Gateway moved money to GPN Data and opened numerous other bank accounts all around the world.

VX Gateway took $8 million from MAP and only return half a million of it.

VX Gateway give ($60 million) to GPN Data - who they claim refuse to repay any of it.

My Advertising Pays closes.

The Advert Platform opens - and uses GPN Data as it's sole payment processor.

Still don't think they're all connected?

Wednesday 4 January 2017

The Advert Platform - Same SCAM Company as My Advertising Pays

The Advert Platform:

The Ad Packs are cheaper, but the same model applies. Every pack makes a loss.

And to get your 'revenue share' you have to spam as many social networks as you can.

So be prepared to have your Facebook accounts terminated.

These are a few of Facebook's rules:

'You will not post unauthorized commercial communications (such as spam) on Facebook.

You will not engage in unlawful multi-level marketing, such as a pyramid scheme, on Facebook.

You will not use your personal timeline primarily for your own commercial gain, and will use a Facebook Page for such purposes.'

Is losing your Facebook etc account worth it?

And this is the definition of Revenue Share from Wikipedia:

'Revenue sharing is the distribution of profits and losses between stakeholders, who could be general partners (and limited partners in a limited partnership), a company's employees, or between companies in a business alliance.

In business

Revenue sharing in Internet marketing is also known as cost per sale, in which the cost of advertising is determined by the revenue generated as a result of the advertisement itself. This method accounts for about 80% of affiliate marketing programs,[1] primarily dominated by online retailers such as Amazon and eBay.[2]

Web-based companies including HubPages, Squidoo, Helium and Infobarrel also practice a form of revenue sharing, in which a company invites writers to create content for a website in exchange for a share of its advertising revenue, giving the authors the possibility of ongoing income from a single piece of work, and guaranteeing to the commissioning company that it will never pay more for content than it generates in advertising revenue. Pay rates vary dramatically from site to site, depending on the success of the site and the popularity of individual articles.'

Note : 'it will never pay more for content than it generates in advertising revenue.'

You are not a 'partner' or an 'employee', you are being charged for a 'service' that ultimately you get a refund from and a little bonus on top. So once again, this 'business model' is not sustainable and will close - just like the previous two versions have done.

*******************************************

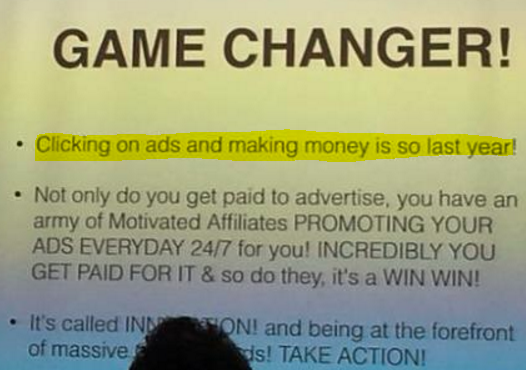

Some shots from Simons event on Saturday 7th January 2017. Simon says clicking on Ads is 'so last year!'

Whatever happened to 'Map is for Life'?

The Ad Packs are cheaper, but the same model applies. Every pack makes a loss.

And to get your 'revenue share' you have to spam as many social networks as you can.

So be prepared to have your Facebook accounts terminated.

These are a few of Facebook's rules:

'You will not post unauthorized commercial communications (such as spam) on Facebook.

You will not engage in unlawful multi-level marketing, such as a pyramid scheme, on Facebook.

You will not use your personal timeline primarily for your own commercial gain, and will use a Facebook Page for such purposes.'

Is losing your Facebook etc account worth it?

And this is the definition of Revenue Share from Wikipedia:

'Revenue sharing is the distribution of profits and losses between stakeholders, who could be general partners (and limited partners in a limited partnership), a company's employees, or between companies in a business alliance.

In business

Revenue sharing in Internet marketing is also known as cost per sale, in which the cost of advertising is determined by the revenue generated as a result of the advertisement itself. This method accounts for about 80% of affiliate marketing programs,[1] primarily dominated by online retailers such as Amazon and eBay.[2]

Web-based companies including HubPages, Squidoo, Helium and Infobarrel also practice a form of revenue sharing, in which a company invites writers to create content for a website in exchange for a share of its advertising revenue, giving the authors the possibility of ongoing income from a single piece of work, and guaranteeing to the commissioning company that it will never pay more for content than it generates in advertising revenue. Pay rates vary dramatically from site to site, depending on the success of the site and the popularity of individual articles.'

Note : 'it will never pay more for content than it generates in advertising revenue.'

You are not a 'partner' or an 'employee', you are being charged for a 'service' that ultimately you get a refund from and a little bonus on top. So once again, this 'business model' is not sustainable and will close - just like the previous two versions have done.

*******************************************

Some shots from Simons event on Saturday 7th January 2017. Simon says clicking on Ads is 'so last year!'

Whatever happened to 'Map is for Life'?

Monday 2 January 2017

The Advert Platform/My Advertising Pays/VX Gateway

VX Gateway have issued an update on the legal case between itself and My Advertising Pays.

They say that it's GPN Data that are holding all the money owed by them to MAP.

And that when GPN return that money, MAPS members can be paid.

Unanswered Questions:

Why aren't VX Gateway taking GPN data to court?

And if GPN Data have been accused of 'stealing' all of MAPS money, then why is Mike using them to process payments for TAP?

And remember the Leaders meeting in January 2016, where Mike said on camera that most of the money has been moved out of VX Gateway?

Where did he move it to?

And if VX Gateway have gone into voluntary Liquidation, and only MAPS is taking them to court, what about all of VX Gateways OTHER clients?

The facts appear to be, that VX has NO other clients.

Which means that VX is there solely to service My Advertising Pays.

Which by definition is a 'partnership'.

If you're owed money by My Advertising Pays/VX Gateway, you need to report them to the US Securities and Exchange Commmission and ACTION FRAUDUK immediately:

ACTION FRAUD UK:

http://www.actionfraud.police.uk/report_fraud

0300 123 2040

The US Securities and Exchange Commission:

SEC, 100 F Street NE, Washington, D.C. 20549-5990.

https://www.sec.gov/complaint.shtml

.

"TRUSTEE UPDATE 2 JAN 2017

DISPUTE WITH (“MAP”)

VX Gateway Inc. in dissolution (hereinafter referred to as “VX Gateway” or “company”) is required by applicable law to gather and collect funds due to it and to defend and protect the company’s assets for the benefit of creditors. The dissolution proceedings were filed by the company on 23 September 2016, as a direct result of unusual transactional behavior by (“MAP”) which caused all of the processors to withhold payments to VX. The filing of the dissolution was voluntary and pre-dates all other known claims or actions. A lawsuit, which the trustees believe to be a false claim and totally without merit has been filed by MAP against the company in the US District Court in Houston, Texas. MAP was seeking a temporary restraining order against the company, which was denied by the US District Court, and a hearing is set in March for the purpose of determining whether the Court has jurisdiction over the matter.

VX Gateway’s legal position is that under its contract with MAP, jurisdiction and venue is Panama and both parties agreed to resolve any dispute in Panama using International Arbitration. Litigating a lawsuit in the United States would, in the opinion of the trustees and the attorneys here in Panama, likely unnecessarily dissipate a substantial amount of money otherwise due claimants in the dissolution. Those claimants include VX Gateway customers, vendors, landlords, utilities, as well as MAP if in fact it is owed any money at all, and others.

There are numerous blogs online that have been reporting misinformation about the litigation and the claim. While many of the postings are MAP members understandably concerned about monies they have not received, it seems likely that much of the misinformation may actually be professional and amateur publicists speaking for the benefit of MAP and its baseless lawsuit.

The purpose of this posting is to address some of the statements and do so in an objective manner if possible.

First, MAP and VX Gateway are two separate and unrelated companies. There is no common ownership. The lawsuit in Houston is specious; it has no basis in fact. The amount claimed as “missing” is made up and not supported by the books and records.

Second, a forensic audit will disclose what if any monies are owed, and by whom. VX Gateway welcomes such audit. All credit card transactions are preserved in the records of Visa and MasterCard; nothing can be hidden in an audit.

Third, many of the blogs describe MAP as a “Ponzi scheme”. VX Gateway investigated the business carefully before accepting its processing and MAP did not, as then doing business, appear to be a Ponzi. Moreover, VX Gateway required, received, and relied upon a formal Legal Opinion Letter from MAP’s attorney, Jonathan Herpy, of the law firm of Hart & David, LLP attesting to the legality of the MAP’s business.

The business concept of MAP appears to be an “advertising arbitrage”, a way of exposing an advertiser’s media to more viewers. Many see it as an extremely creative concept that apparently worked well for a while at least with regard to attracting a large following.

Following the publicity attendant to the lawsuit we have heard from several observers that whether or not the business scheme truly benefits the advertisers seems questionable because the additional exposure sought by advertisers are in reality “hollow clicks”, that is people looking at the ads because they are paid to do so, not because they have actual interest in the product or service. One would think that over time fewer and fewer advertisers would utilize such a service. We have quite recently been told that there is also the issue of whether the MAP members have a viable long term device for creating income after expenses or if the payout scheme of MAP is weighted in such a manner that the business must eventually fail. Those concerns, however, are matters between MAP and its members.

As a payment gateway VX Gateway provided a service of presenting credit card charges to one or more processors (different processors are often needed to handle transactions in different currencies or countries), after which each payment must be settled and when approved money credited/paid by the processor to the payment gateway. Those funds do not belong to the payment gateway except for its processing fees. After receipt of such funds from the processor the net amounts due are remitted or credited to the merchant, here MAP. The sheer volume of transactions requires software that virtually automates the entire payment process from start to finish. Every payee’s account is paid/credited automatically.

Critical to understanding the process, by contract and industry practice, the payment gateway, VX Gateway, has no debt and owes nothing to the merchant until it receives the payment from the processor, here GPN Data (hereinafter referred to as “GPN”). GPN has withheld payments due VX Gateway. As part of the dissolution process VX Gateway is, as stated above, pursuing an audit. When and if GPN eventually pays its lawful obligations such funds should be received in the dissolution. At such time, and only at such time, money payable to any party will be credited to the account of and become payable to any party due money from the respective transactions. In other words, at such time money owed to MAP, if any, will be paid.

We find it interesting that GPN, the party that owes the money but has thus far refused to pay, is now doing business directly with MAP which is claiming the money. If they can work together to take money from MAP’s members, cannot GPN pay VX Gateway the money VX Gateway is owed in order that we may pass through that part that will then be owed to MAP? From whatever amount it is then owed and paid MAP could then pay its members some or all of what it has withheld from them.

Make no mistake, any money that may become payable by VX Gateway to MAP, if any, is a part of the money GPN has withheld from paying to VX Gateway. We reiterate, by contract and industry practice no debt is incurred by VX Gateway until it is paid by the processor, here GPN Data.

It should be noted that Mike Deese signed a personal guarantee to make good any monies owed to VX Gateway when he applied for VX Gateway services.

VX Gateway’s position is that the actual amount in controversy in any legal proceeding in Panama can easily be determined by third party audit. Once done VX Gateway intends to be bound by the audit.

There would appear to be no good faith reason for MAP to oppose such a determination. At the instruction of Jonathan Herpy of Hart & David law firm, a total of USD 8 million, consisting of two (2) payments of USD 4 million each was paid to the law firm’s escrow account. Bearing in mind that VX Gateway itself will owe nothing until it is paid by GPN, one might ask first, as to money previously paid to MAP, where has the money gone?

Only Mike Deese and MAP’s attorney Jonathan Herpy and the Hart & David law firm can provide that answer. Second, as to such monies and monies as yet not received by VX Gateway from GPN, is there some collusion between MAP and GPN? We express no opinion on that issue.

Counsel in Panama has speculated that the lawsuit improperly filed in the US is likely a sham intended instead to draw attention away from MAP and its principals. If that is correct, one must wonder what are they trying to hide? Again, we express no opinion.

Legal counsel has advised that VX Gateway and others may pursue legal action against MAP and GPN and their respective spokesmen individually for slanderous and disparaging statements made by them claiming that monies have been stolen by VX Gateway or related parties. In fact, such actions may follow but the focus of VX Gateway is presently upon collecting monies as yet unpaid by GPN in order that it may be paid to the rightful recipients.

Many people apparently have claims against MAP; not all of those people have claims against VX Gateway. Those that may have a legitimate claim in the VX Gateway dissolution are encouraged to file a proper claim in the dissolution at the earliest possible time in strict accordance with procedure set forth on this website. Please note: Claims that are not submitted with the required Enhanced Know Your Customer documentation will be rejected and must be resubmitted.

VX Gateway in dissolution prepared this statement based on the information available to it, including information derived from public sources that have not been independently verified. No representation or warranty, express or implied, is provided in relation to the fairness, accuracy, correctness, completeness or reliability of the information, opinions or conclusions expressed herein. The financial information included in this presentation is preliminary, unaudited and subject to revision upon completion of the Company's closing and audit processes, as well as independent third party audits. This presentation is not a legal opinion, but general discussion, not intended to deal with or disclose particulars of any specific issue, legal, business, or otherwise. All applicable statutes and regulations control."

Subscribe to:

Posts (Atom)